BSL and private debt “can coexist”

Competition from the broadly syndicated loan (BSL) market is not a bad thing for private debt, according to Benefit Street Partners’ head of research Anant Kumar.

The asset manager’s managing director noted that “there’s always a certain degree of tension between syndicated loans and direct lending”, with growth in the latter meaning that it is now competing much more strongly for deals.

The fiercest competition is in the upper middle market – companies with EBITDA north of $100m (£80.4m) – where we are seeing “the blurring of lines between BSL and larger direct lending deals,” he added.

Read more: Wall Street wins $16bn from private credit market

“Corporates will often run a dual-track process, involving both a BSL option and a direct lending financing package,” he said. “There should be an illiquidity premium for the direct lending alternative but that’s becoming compressed, and often times there’s very little to distinguish syndicated lending and direct lending on bigger deals.”

In the core middle market it is a different story, as those companies cannot tap the bank market, Kumar said.

“Due to the trickle-down effect, spreads are starting to get compressed here as well, but there’s still a discernible illiquidity premium in core middle market direct lending. It’s not as good as it was during the dislocation 18 months ago, but it’s still attractive from a longer term historical perspective.”

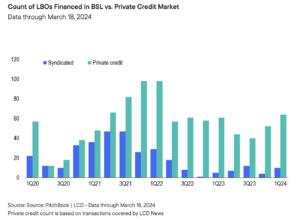

While the BSL market is estimated to have taken $11bn or more away from private debt deals, Kumar argues that this competition is a positive as “both of those asset classes can coexist”.

“If you avoid some of the frothier upper middle market deals, there are still enough distinctions,” he added.

However, a downside of the increased competition in the upper-middle-market segment is that there may be more risk-taking.

Some bad syndicated loan practices are now entering the direct lending world, Kumar said, such as covenant-lite on bigger deals.

This could spread to the core middle market, although it is more sheltered from competition.

Trouble ahead?

The BSL market is having its moment right now but that comes in waves.

High interest rates raise the prospect of imminent defaults as corporates struggle to repay their debts, while hopes of base rate cuts have been lowered in recent months.

“Once you start to see signs of distress in the BSL market, either via ratings downgrades or price moves, the window for easy access to capital can narrow rapidly as banks pull back,” Kumar said.

Read more: Banks fight back against private credit boom as borrowers seek out savings

“CLOs make up the lion’s share of the BSL market and they have strict documentation making it punitive to hold CCC-rated loans in excess of a 7.5 per cent bucket. That bucket has been filling up in recent years and stands at about five to six per cent currently, depending on how you slice the data. If we were to see a bunch of downgrades over a short period of time, that could tip the bucket over and lead to a wave of selling that could roil the market.

“Higher for longer rates will result in marginal borrowers getting more stressed. If they become forced sellers, the window open right now could shut pretty quickly.

“Then private debt may be the only game in town again, like in 2022.”