P2P investing stands out in record year for alternatives

Peer-to-peer lending is standing out amongst alternative investments as it offers more transparency, taps a growing market and sets to benefit from higher interest rates.

The P2P lending market is expected to grow significantly to be valued at $1.14trn (£1trn) by 2031 globally, according to Transparency Market Research. As the investment opportunity grows, it is also important to consider what it offers investors.

Research from Peer2Peer Finance News earlier this year found that Innovative Finance ISAs (IFISAs) returned an average of 9.01 per cent over 2021. It has managed to deliver stable returns through difficult economic conditions.

In addition, the asset class is seen as offering a greater level or transparency than some other alternative asset classes such as private equity or hedge funds, even though these might have the chance for greater rewards, albeit with more risk.

“The problem with whisky and arts, as it is with most alternative asset classes, is finding the data and information you need to assess whether it’s a good opportunity or not,” said Neil Faulkner, chief executive and head of research at P2P ratings firm 4thWay.

“It is one of the reasons P2P lending stands out.

“P2P is an unusual, innovative idea in that it is so transparent and you can measure it so much more easily than most other alternative investments or innovations in investing.”

He added that the vast majority of P2P investors have enjoyed stable returns through the years, proving that the sector can offer investors value.

Peer2Peer Finance News’ research found that in 2020, the average annual return on IFISA accounts was 9.04 per cent. During the 2020/21 financial year, the average target return being offered across 32 IFISA accounts was 8.72 per cent. In 2019, it was 8.45 per cent, and in 2018 it was 8.3 per cent.

Best year for alternatives

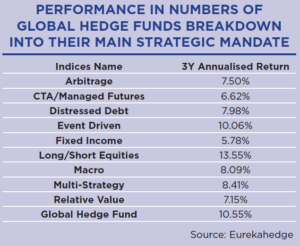

Many alternative asset classes had a stellar year in 2021, delivering investors record-breaking returns. For example, hedge funds had their second-best annual performance since 2010 according to figures from Eurekahedge.

The company’s hedge fund index was 9.38 per cent higher at the end of 2021, reversing losses from November. Among the different strategies, those focused on North America and Japan had strong performance, returning 14.7 per cent and 9.18 per cent, respectively.

Meanwhile, short volatility strategies and commodities delivered 15.42 per cent and 15.24 per cent, respectively.

PitchBook data showed that real estate funds recorded a rolling one-year horizon internal rate of return (IRR) of 24.8 per cent, the asset class’s best performance since the second quarter of 2011. As more investors turned to real estate in response to rising inflation and interest rates, funds have continued to offer decent returns in 2022 as well, registering a 7.32 per cent return in the first quarter of the year, according to latest data from PitchBook.

Read more: Zopa eyes acquisitions in different sectors

Real assets continued to improve their performance last year, reaching 20.7 per cent rolling one-year horizon IRR, according to PitchBook, which was also the highest seen since 2021. There was however, significant variance among sectors. For example, oil and gas real assets returned 43.7 per cent at the end of 2021, becoming the best performing real assets sector.

Anikka Villegas, analyst at PitchBook, noted: “Given the correlation between oil and gas prices and fund returns, this may not come as a surprise, as supply-demand imbalances resulting from Covid-19 price plunges, production lulls, and rebounding post-pandemic demand boosted prices in the second half of 2021.”

Meanwhile, infrastructure returns reached 15.3 per cent, boosted by the demand for supply chain-related assets impacted by the pandemic. Metals, timber and agriculture returned -1.2 per cent over the period, hurt from pandemic disruption.

Private debt performance in the last quarter of 2021 was 3.2 per cent, taking the one-year horizon IRR to 14.9 per cent, well below the 37.6 per cent posted for all private capital funds.

While these figures show that alternatives had a strong 2021, it is difficult to compare them directly to returns in P2P lending. One of the reasons is a lack of transparency, with data relying on sporadic self-reporting from firms themselves and disclosures from investors. The other problem is the use of IRR as a metric, which has been widely criticised as it can be artificially bolstered by funds and therefore not give a true indication of what investors actually receive in the end.

Accessibility a problem

Although, based on the available data, many alternative asset classes have delivered significant returns, most of the funds PitchBook covers are out of the reach of retail investors. But for those that want to invest in alternative asset classes such as private equity, venture capital, property or infrastructure, listed investment companies are available.

However, the returns for these have been under more pressure as they are also impacted by share price movements. Still, they managed to record positive returns through the year.

The infrastructure sector delivered a net asset value return of 7.45 per cent over in 2021, according to the Association of Investment Companies data. The sector’s share price return over the same period was 7.38 per cent.

Private equity investment trusts had a great year, delivering a 29.85 per cent average NAV return and a share price return of 34.14 per cent.

Direct lending funds’ NAV return in 2021 was 9.77 per cent and their average share price return was 12.33 per cent.

UK logistics focused real estate investment trusts also had a stellar year with an average NAV return of 19.34 per cent and a share price return of 50.9 per cent.

Other areas investors have recently turned to for uncorrelated returns were litigation and equipment finance, and art investments, according to Neel Aryan Birla, head of investor relations at Hedonova, an alternative investment fund with allocations to hedge funds, art, private assets and P2P lending, among others.

Birla said litigation finance has historically delivered around 44 to 55 per cent, with equipment finance returning between 32 and 36 per cent. Over the last year, contemporary art has also been doing very well. The Artprice100 index was up 36 per cent in 2021.

Lower fees

One other advantage of P2P lending is that it can be lower cost for investors. While there are generally fees attached to borrowing on P2P platforms, many platforms do not charge fees to invest in P2P loans.

This is very different from other alternative investments, where allocations are typically through a fund that charges an annual management fee and a performance fee.

Read more: Less than two months until the Peer2Peer Finance Awards!