Schroders Capital notes attractiveness of private debt

Schroders Capital chief investment officer Nils Rode has outlined the firm’s investment priorities, heading into the second quarter of 2024.

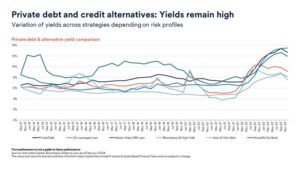

Rode said debt and credit alternatives remain attractive, as interest rates stay high and banks, particularly in the US and Europe, continue to retreat.

“As risk premiums in the liquid debt market have collapsed, private debt and credit appear very attractive,” he said. “We favour investments offering high income and benefiting from capital provision inefficiencies.”

These include defensive income from infrastructure debt with low-volatility cash flows, opportunistic income from sectors with distress that causes emotional bias, uncorrelated income from sectors such as insurance-linked securities, and income capitalising on changes in bank regulation, such as asset-based finance or microfinance.

Read more: Schroders boosts private debt team with double hire

“With many syndicated markets rallying in quarter four, yield spread premiums have significantly reduced, even in previously cheaper liquid markets like collateralised loan obligations and asset-backed securities,” Rode said.

He added that insurance-linked securities are valuable for portfolio diversification due to their lack of correlation with macroeconomic conditions and offer attractive returns due to higher yields driven by reinsurance limitations.

He also pointed to asset-based finance as a key area due to its diversity and the benefits of Basel III impacts in the US. Opportunities include equipment, consumer, and housing, and can be accessed directly, via financing, or through risk transfer mechanisms such as bank capital relief.

“As investors face extensions in their traditional private debt book’s maturity, strategies generating cash flow, particularly with near-term income or capital return – as is the norm in asset-based finance – are in greater demand,” he said.

Read more: Private markets become ‘a mainstay’ of insurance portfolios

Talking more generally about the outlook for the second quarter of 2024, Rode said private markets had “largely reverted to pre-pandemic levels in terms of fundraising, investment activity, and valuations, creating a favourable environment for new investments”.

However, he said where 2023 has seen fundraising concentrated on large funds, Schroders is looking for small and mid-sized private market strategies.

Looking further ahead he said interest rates were likely to remain higher for longer, but easing inflation and potential interest rate cuts would provide a tailwind for private market investments in the short to mid-term.

“This is especially true for real estate, where significant valuation corrections have occurred, and our proprietary valuation frameworks suggest that 2024 and 2025 may be attractive years for new investments,” he added.

Despite a broadly positive outlook for private markets, Rode flagged ongoing geopolitical risks, domestic political tensions, and risks from ongoing conflicts, making it important to maintain selectivity and robust diversification within private market allocations.

Read more: Schroders Capital hires global head of business development and product