Mezzanine debt set to grow in 2024

Mezzanine deals are predicted to surge this year, as high interest rates and tighter credit conditions present opportunities for lenders.

Mezzanine debt bridges the gap between senior debt and equity financing and is one of the higher-risk forms of debt, producing returns of up to 20 per cent.

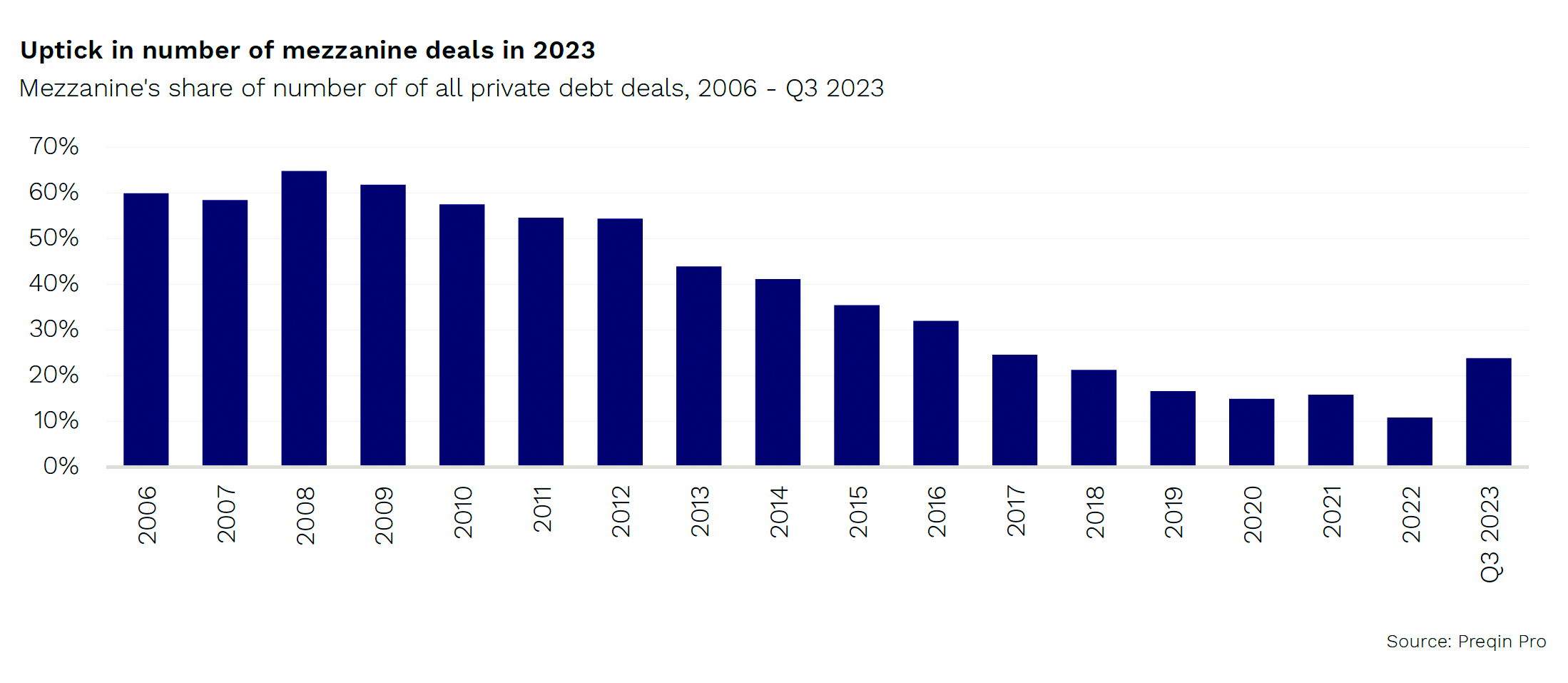

It had been through a decade-long period of decline, going from 68 per cent of private debt deals in 2009 to 11 per cent in 2022, according to Preqin data.

Industry stakeholders attributed this decline to private credit lenders’ focus on other types of financing such as unitranche deals, which combine senior and junior debt into a single loan.

Read more: Fintex Capital provides additional mezzanine finance to ThinCats

However, in 2023, mezzanine’s share of the number of private debt deals rose to 24 per cent. Higher interest rates and tougher lending conditions – combined with regional bank turmoil in the US – have led to a recovery in demand for mezzanine financing.

There was a 55 per cent year-on-year increase in mezzanine fundraising in 2023 to $40.6bn (£32bn), as investors look to gain exposure to higher return private debt assets.

Damien Guichard, head of European private credit at Allianz Global Investors, said he expects to see more mezzanine debt transactions this year.

“We’re seeing some rebalancing now away from unitranche transactions towards traditional senior debt,” he said.

“Unitranche loans have been the winning format over the past decade. They’re not going to go away but we’re seeing a move towards more conservative, traditional senior debt with lower interest rates.

“There will probably be more mezzanine debt transactions this year. It goes back to what I said about more senior debt structures coming into the market, and they often come with a mezzanine layer.”

David Bouchoucha, head of private debt and real assets at BNP Paribas Asset Management, also said he sees opportunities in junior debt this year, which includes mezzanine financing.

“A junior tranche is very interesting and we are trying to convince more investors to do this,” he said.

“The incremental risk compared to pure senior debt remains quite marginal.”

Read more: Private debt market to grow to $2.8trn as number of funds hits record high

Mezzanine debt is certainly making a mark on the private debt landscape again.

Three of the top five largest private debt funds to close last year were mezzanine, according to Preqin data.

HPS Investment Partners’ HPS Strategic Investment Partners V closed in April 2023 having raised $17bn.

That was followed by Goldman Sachs’ GS Mezzanine Partners VIII, which raised $11.7bn in January that year.

The fourth largest fund was Crescent Capital Group’s Crescent Credit Solutions VIII, which raised $8bn in February 2023.

However, macroeconomic challenges are a potential headwind for mezzanine debt. Preqin’s latest investor survey in November 2023 found that 27 per cent of limited partners said mezzanine debt offers the best opportunities for investment over the next 12 months. This was down from 38 per cent in June 2022.

Read more: Global private debt fundraising in 2023 slightly down from 2022

“This may be down to investors weighing the benefit of higher spreads with mezzanine debt against the risk of recession, and how that might impact more junior debt positions,” Preqin said. “If we see an increase in defaults in the broader economy, investors could shift their preferences to strategies that can benefit from this, such as distressed.

“It seems likely to us that the outlook for mezzanine debt will be entwined with investors’ macroeconomic outlook. Although distressed debt and mezzanine debt both entail higher ex-ante risk than direct lending, they allow investors to express different views on how the future will pan out.”