Where is the ‘Private Credit+’ technology infrastructure?

Private Credit+ is a $45tn total addressable market opportunity, but the systems currently supporting this market, retrofitted from private equity or capital markets, cobbled together through M&A, or scattered across disconnected point solutions, are fundamentally inadequate. The current landscape isn’t just operationally inefficient; it’s preventing firms from scaling. Kanav Kalia, managing director at Oxane Partners, makes the case for why the industry doesn’t just need tools, but needs purpose-built technology infrastructure.

Private credit has expanded far beyond corporate direct lending into a much broader opportunity set, which we are calling Private Credit+. In our recent whitepaper, we outline that the total addressable market opportunity for all Private Credit+ strategies stands at a staggering $45tn (£33.6tn). We’ve all seen the sector rapidly expand and this now covers multiple asset classes such as asset-based finance, direct lending, commercial real estate finance, infrastructure finance, fund finance and securitised products – with each day, innovation in this competitive space is opening new opportunities for investors. We are now looking at unparalleled scale and complexity issues. Investment firms must now master new challenges around multi-asset strategies, cross-exposure, aggregate risk and diverse reporting requirements. Legacy systems will struggle to keep up, meaning significant investment and overhauls are required in order to capitalise on this $45tn opportunity.

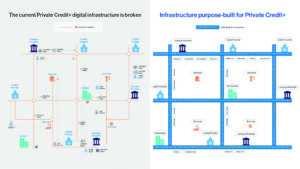

Why the current digital infrastructure is broken

Much of the Private Credit+ world is currently operating on legacy platforms originally built for private equity or capital market strategies and then retrofitted for Private Credit+ through add-ons and workarounds. These platforms don’t cater to asset class nuances and provide limited flexibility and coverage for the breadth of Private Credit+ asset classes. They are temporary solutions at best. The M&A route hasn’t solved the problem either. With money flowing into the space, we’ve seen providers acquire and combine solutions that look good on paper. Big deals will always appear impressive and signal ambition, but these come with inherent integration challenges and often don’t provide full functionality for the depth and breadth of needs of Private Credit+ strategies.

Beyond these, other solutions have emerged. Point solutions have filled some gaps, offering specialised tools for specific workflows like valuations and monitoring, or focusing on individual asset classes. Unfortunately, they are limited in scope and private credit firms collecting these then risk having a cluttered tech stack. This can also end up creating silos and a lot of overhead for managing different workflows. Some firms have pursued in-house technology solutions, building custom platforms tailored to their needs. This approach requires significant time, investment, and product development expertise that most firms simply don’t have.

How this infrastructure gap plays out in daily operations

Let’s trace how capital flows through Private Credit+. Investors – pension funds, insurers, sovereign wealth funds, high-net-worth individuals, individual investors in some cases – commit capital to private credit funds. GPs and investment firms then effectively become the capital providers and often leverage this capital with bank financing. They lend to borrowers across the spectrum: middle market companies, sponsors, originators and more. So, we have four key participants in the capital layer – investors providing equity, GPs orchestrating deployment, banks providing leverage, borrowers receiving capital. That’s the easy part.

Now overlay the operational layer that actually makes Private Credit+ function. Every loan requires multiple counterparties – agents, collateral administrators, servicers, trustees – managing everything from borrower communication, waterfall calculations, payments, borrowing bases, compliance to reporting. Each asset class adds its own specialists: real estate needs valuers and property managers, infrastructure requires project monitors and technical advisors, asset-based finance involves specialists across areas from consumer loans to art financing. Each counterparty needs and provides specific information to function: borrower financials, market data, valuations, legal documentation and more. A single loan might involve 10 different parties exchanging data through dozens of channels. Multiply that across hundreds of loans, and you have thousands of information streams with no central infrastructure. The resulting information chaos is staggering.

Infrastructure purpose-built for Private Credit+

What Private Credit+ needs is a fundamental infrastructure transformation. While capital wants to flow at highway speeds, it’s constrained by manual processes, fragmented systems, and information chaos. The solution isn’t about adding more tools, it’s about building a digital expressway that can handle the speed and scale of Private Credit+.

A digital expressway would connect all participants – investors, GPs, lenders, borrowers, and operational counterparties – on unified digital rails. Instead of information crawling through email chains and Excel files, a digital expressway would enable seamless information flow. Instead of each firm struggling to build their own escape routes, the industry would benefit from shared, scalable infrastructure. This digital expressway must handle the sophistication of Private Credit+: the nuances of each asset class, complex deal structures, multi-currency facilities, and more. It would transform operational chaos into competitive advantage, turning information from a burden into a strategic asset.

At Oxane Partners, we’ve seen firsthand what it takes to support Private Credit+ at scale. Managing over $800bn of Private Credit+ AUM for some of the top banks and private credit firms, we understand that incremental improvements won’t suffice. The industry needs a fundamental leap forward. It requires building from first principles, which is why we created Oxane Panorama, the digital expressway that eliminates friction between parties and enables sophisticated strategies at scale. It’s not just software, but the infrastructure needed to simplify, digitalise, and transform how Private Credit+ is managed. We are bringing together data, workflows, and all stakeholders onto a unified platform that eliminates friction, enhances transparency, and enables smarter decisions.

The market is ready. The infrastructure must follow. And we’re building it, for the scale and complexity that a $45tn opportunity demands.