SMEs repay record £9.79bn in 2023

Small- and medium-sized enterprises (SMEs) repaid the record sum of almost £10bn across 2023, according to Ebury’s SME Borrowing Tracker.

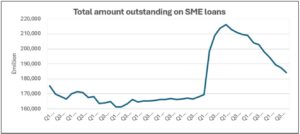

By analysing Bank of England data, Ebury found that total outstanding debt stood at £184.32bn in the final quarter of 2023, marking a seven per cent or £13.57bn decline in debt when compared to the same period of 2022 (£197.89bn). It is also a £25.45bn decline when compared to the final quarter of 2021 (£209.77bn).

The final three months of 2023 marked the largest quarterly change in SME loans outstanding for the year because repayments accelerated towards the end of the year.

The £9.79bn repaid represented a £1.98bn increase from net repayments made in 2022, which stood at £7.81bn, and a £1.64bn increase from the net repayments made in 2021 which was £8.14bn.

Read more: SMEs resilient in spite of higher debt costs, BOE finds

It signals the largest annual repayment total since the covid-19 pandemic in 2020, which saw net loans of £44bn accumulated as businesses sought financial help to survive the unprecedented economic restrictions.

With holding interest rates held at 5.25 per cent since August 2023, SMEs are hurrying to make repayments in a bid to minimise the heightened cost of debt.

While the first rate cut is priced in by markets for August 2024, the cost of borrowing for businesses is expected to remain elevated for some time.

The majority of SME lending during the pandemic was provided through the government-backed coronavirus business interruption loan scheme (CBILS), of which Ebury was an accredited lender.

Through figures from the department for business and trade and the department for business, energy and industrial strategy, Ebury found that £25.9bn was loaned out to around 100,000 firms under the CBILS scheme. However, under a third (30 per cent) of CBILS facilities have been repaid.

Read more: Covid loans “hobbling the restructuring space”

That business support was launched amid a broader package of help including additional loans, the bounce back loan scheme, capital repayment holidays, extended overdrafts and asset-based finance.

“While the cost of borrowing appears to have peaked and is expected to begin falling this year as the Bank of England brings down its base rate, SMEs are nonetheless continuing to make significant repayments,” said Ebury UK country manager Phil Monkhouse.

“Businesses have seen significant volatility in the economic landscape from the restrictions experienced during the pandemic and surging interest rates, to geopolitical tensions driving supply chain bottlenecks and a significant energy shock.

“It has led to a period of SMEs tightening belts and increased focus on bringing down their debt levels to weather this uncertainty and put themselves in a strong position for future growth as we hopefully begin to head towards calmer times. Moving forward, SMEs will need to remain agile with ready access to finance and appropriate hedging facilities to capitalise on the opportunities ahead.”

Read more: SMEs rush to repay Covid loans amid higher interest rates