The P2P platform must-have feature in 2021

Fintech companies have long been working to expand access to investment opportunities for a variety of investors. And although all investor classes come with their unique requirements, few have impacted investment platforms as much as retail investors. With more and more industry leaders now focused on attracting these new investors, firms are being forced to acquire investment platforms that will allow them to keep up with this market shift.

As companies race to build or acquire these platforms, it’s important for them to keep in mind what key functionalities must be included. Here, we’ll take a look at why auto invest is a must-have feature for all investment firms looking to keep the pace with the dominant market trends in 2021.

What is auto invest?

Auto invest is a feature of investment platforms that allows investors to take a less active role in managing their investments without sacrificing any control. This is a feature that’s essential to all investors who are not able to be focused on their investments full-time.

To accomplish this, auto invest enables investors to pre-select their investment criteria according to their personal investment strategy and let the algorithm “do the grunt work” for them. This way, investors can be sure not to miss any opportunities while only getting involved in deals that have been precisely matched to their pre-defined criteria.

As far as firms are concerned, having a platform with auto invest features can make a huge difference in the amount of capital investors commit, their reinvestment rates, and the overall quality of the investor relationship.

How does it work?

Auto invest uses a complex Conditional Logic Investment Algorithm to deliver platform users the investment opportunities they’re targeting. There are countless things that it takes into account before surfacing these deals and many of the parameters are set by the investors themselves.

These often include setting the desired time horizon, risk profile, sector preference, maximum investment amounts and more. The algorithm takes into account all available data to locate the deals that will allow investors to achieve investment goals and asset allocation.

Investor benefits of auto invest

Intuitive design:

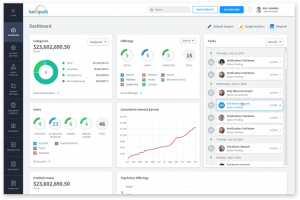

This feature makes investing simple, to the point of making it almost “gamified”. Platforms with auto invest have been designed with retail investors in mind and are equipped with user-friendly dashboards and intuitive interfaces to make the set-up process easy, even for users that are not tech savvy.

Advanced security

Still, investors are often understandably reluctant to automate their investing in this way. To create an atmosphere where users are comfortable investing this way, platforms provide advanced security features such as two-factor authentication and real-time email activity notifications.

No manual searching

Perhaps the main advantage of this feature is that it allows investors to make better use of the time they spend allocating their investments. This is why auto invest is often seen as the prerequisite feature for making passive investing possible on a platform. At the same time, the algorithm won’t allocate your funds on just any deal on the market if it doesn’t meet all matching criteria – you are still the one that decides how you invest.

Frequently asked questions

How does auto invest increase investor activity?

Auto invest is a highly engaging investor tool that is active even when the investor isn’t online. Investors are drawn into their dashboards to see new investment activity and earned interest payments.

Are there any compliance risks with using auto-invest?

Holding investors’ money requires specialised financial licenses but it is possible to work with third party firms to meet regulatory requirements as well. Consult your legal counsel to understand how you can leverage this powerful feature set with your investor base.

Do investors not using auto-invest have a fair chance at getting allocations?

Auto-invest algorithms can be configured so that all investors get a balanced and fair allocation into each respective deal based on the investor demand and desired investment amounts.

Interested in improving your investor servicing with auto invest? Contact Katipult and learn more!

Auto invest is a part of the Katipult cloud-based, end-to-end lending solution for commercial and consumer loans that makes managing loans simple. If you are interested, do not hesitate to reach out to our solution experts for more information.