Navigating the ISA market

Traditionally, ISA users have faced a choice between saving into a cash tax wrapper or investing in stocks and shares, but now the Innovative Finance ISA is providing a middle ground

CHOOSING WHERE TO place your ISA allowance each year can be tough. A cash ISA provides a defined rate of interest but the best returns are typically below inflation.

In contrast, investors can aim for higher returns by investing in the stock market with a stocks and shares ISA.

But this brings stock market volatility and the risk of losing your money, alongside fees for the investment wrapper and for a financial adviser, if one is used.

What if you could combine that fixed rate of interest with a little extra risk? Enter the Innovative Finance ISA (IFISA).

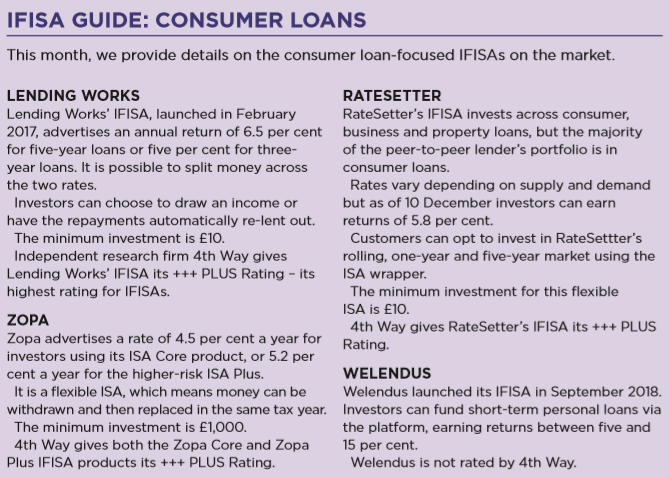

The IFISA lets investors earn their peer-to-peer loan interest tax-free. Returns range from 3.54 per cent with Landbay or 4.5 per cent with Zopa to double figures with platforms such as LandlordInvest, Proplend and Ablrate.

In contrast, the best rate on a cash ISA comes in at around two per cent.

“It may be tempting to open a basic cash savings ISA, but some savings goals are for the longer-term, so instead consumers may wish to consider investing differently,” explains Rachel Springall, personal finance expert at comparison website Moneyfacts.

“IFISAs allow savers to invest using P2P, so for those frustrated with low returns on cash ISAs, these could be an enticing alternative.

“Savers will still earn tax-free interest thanks to the ISA wrapper, but it is worth remembering that capital is at risk and they are effectively lending out their cash via P2P for an interest return.”

Read more: George Osborne confident about IFISA success despite slow start

She said cash ISA take-up has also been impeded by the launch of the personal savings allowance (PSA), which lets basic rate taxpayers earn £1,000 on a savings account – £500 for higher-rate earners – before having to pay any tax.

“The influence of the PSA has dampened the popularity of cash ISAs, as savers will find better returns on non-ISAs right now, particularly on fixed bonds,” she explains.

“Therefore, if savers are looking specifically for an ISA, they would be wise to look at all the options available to them to see which would be the most lucrative based on their circumstances.

“If competition outside of cash ISA season doesn’t improve, we could see fewer subscriptions over the next few years if they continue to fall out of favour.”

The number of savers opening cash ISAs fell by 8.2 per cent in the previous tax year, which P2P lenders say has created a gap in the market.

P2P platforms see the poor returns on cash as an opportunity for their IFISA products.

“The low base rate means cash ISAs aren’t beating inflation,” says Stuart Law, chief executive of Assetz Capital.

“While IFISAs do carry risk, we feel they are a great vehicle to include in a diversified portfolio.

“This success is down to us providing a proper alternative and fulfilling an untapped demand. “We aim to balance healthy returns with a degree of risk. Investors want flexibility with their investments, which is why we provide ISA wrappers on all of our accounts.”

It isn’t just those turning away from cash ISAs that could be tempted by the IFISA.

Sam Handfield Jones, head of Octopus Choice, says many ISA users may also find they are putting too much into a stock and shares wrapper and want to diversify their portfolio.

“A lot of people are probably overly cautious and end up with too much money in a cash ISA,” he explains.

“The alternative is a stocks and shares ISA, which the majority of advisers would encourage their clients to do as you are using the wrapper on an asset class that can target the best returns for you.

“Although that may make logical sense, there are more emotional things at play, as the idea of putting everything into stocks and shares may be too much for someone who is nervous about the market.

“There are individuals who are overweight on cash and want to take more risk and conversely there are those with a lot invested in the markets who want to take down their volatility and move funds into an IFISA.”

Read more: IFISA providers call for tailored HMRC submissions process

Frazer Fearnhead, founder of The House Crowd, agrees that tackling volatility is as big an issue for investors as getting a decent rate is for cash ISA savers.

“Stocks and shares ISAs are so volatile, you can have a good year one year and then have 30 to 40 per cent knocked off the next,” he explains.

“The IFISA provides a more predictable and consistent way to reach your goals.”

The IFISA wrapper is also providing a way for financial advisers to access P2P, which is an area that the sector has typically been wary of due to the lack of Financial Compensation Scheme Protection (FSCS) and a relatively short track record.

“What we sometimes look to do is create portfolios that have a low correlation to equities with the potential returns that keep it above cash and inflation,” explains Max Spurgeon, an adviser for Legal & Medical Investments who recommends the Octopus Choice IFISA.

“It typically works for clients with high cash reserves who may have been reticent to invest in recent times.

“We have to be conscious that there is no FSCS cover and there is risk to capital, which is a limiting factor on how much we would put in.

“A platform like Octopus Choice at least has the property as security, which reduces some of the risk, but we wouldn’t be doing this with anybody that feared losing capital.”

David Lumley, an adviser for Arena Wealth, says IFISAs suit clients that are looking for income. He recommends products offered by LendInvest, Proplend and Downing to his clients.

“The IFISA can produce a decent yield, albeit with more risk that can be controlled well by investing in loans with security and by diversification across platforms,” he says.

“It typically works with someone who needs to generate income from their portfolio.

“I personally invest in a wider range of P2P platforms to test them out first but I will always let a client meet the people behind them so they can ask any questions.”

There are of course some unique risks to the IFISA that you would not get with cash or shares, such as bad debts, although you could similarly lose money on the stock market.

Read more: Government urged to push ‘positive’ IFISA investing benefits

Moneyfacts’ Springall highlights issues such as not being able to subscribe new money into more than one IFISA per tax year and less flexibility on withdrawing funds with some IFISA products.

Handfield-Jones of Octopus Choice points out that it is important to remember that not all IFISAs are the same.

“P2P is just the label,” he says.

“Investors need to consider the underlying asset class.”

Platforms like Octopus Choice and Landbay are offering loans secured on property, which provides extra reassurance that the asset can be sold to repay bad debts, assuming a decent price and buyer can be found.

Others, such as Zopa and Funding Circle, have unsecured loans in their IFISA but have experienced credit teams and low rates of arrears and defaults.

The IFISA is only into its third tax year. It attracted almost £300m in 2017/2018, but it still has a way to go to catch up with the £39.8bn subscribed in cash ISAs and £28.7bn in stocks and shares over the same period.

But there is clearly an appetite, especially if savings rates remain low and if ongoing macroeconomic uncertainty pushes investors to reduce their exposure to volatile stock markets.